- HOW TO GET AN APP FOR MY BUSINESS FOR FREE

- HOW TO GET AN APP FOR MY BUSINESS PDF

- HOW TO GET AN APP FOR MY BUSINESS DOWNLOAD

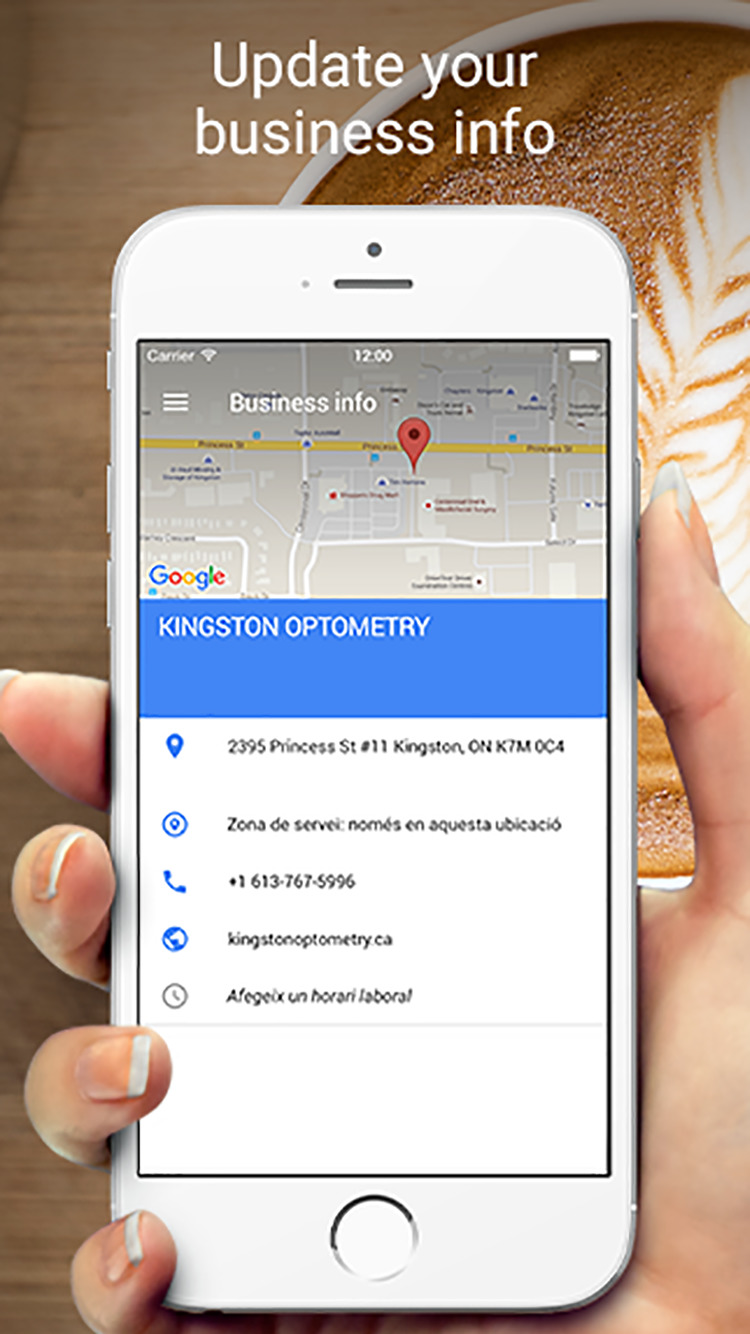

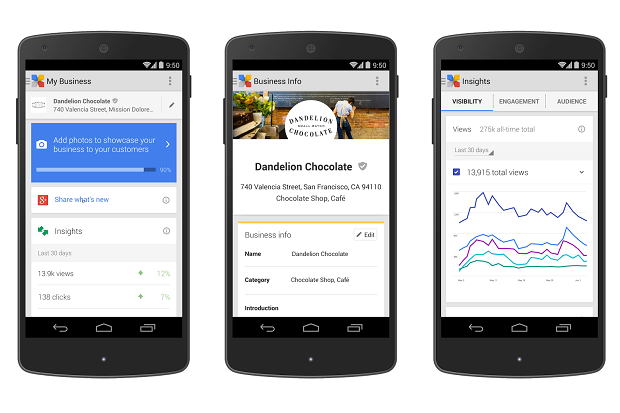

Make edits to your Business Profile on your phone and see those changes online on Google in real time.

HOW TO GET AN APP FOR MY BUSINESS FOR FREE

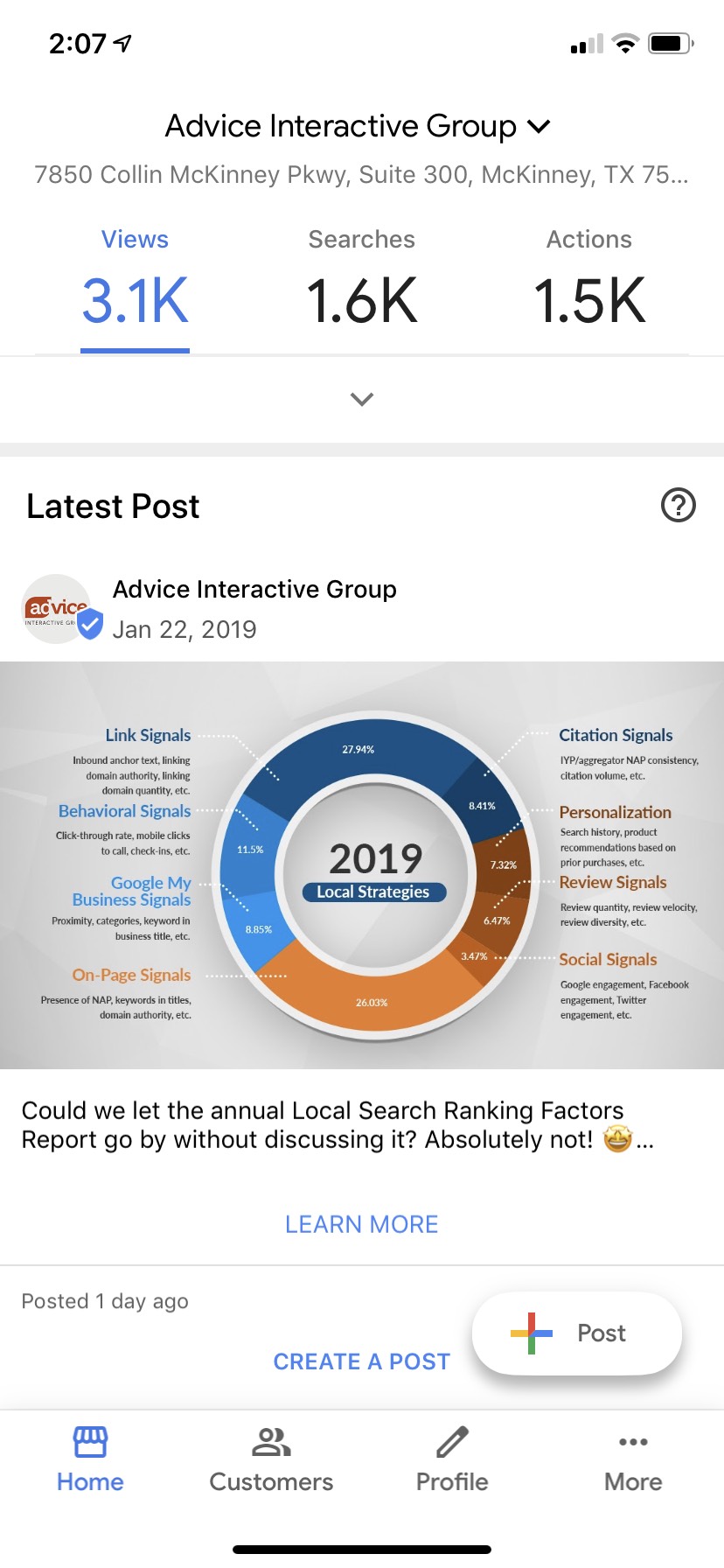

Make your Business Profile on Google stand out for free and turn those searches into your customers with the Google My Business app. You would be subject to automatic revocation of your exemption if you fail to file for the three periods that end Decem(return/notice due May 15, 2017) or for any consecutive three-year period thereafter.Every day, millions of people search on Google for businesses like yours. Your first tax period would end on December 31, 2014, and your first return or notice (if your organization does not meet one of the few exceptions to the annual reporting requirement) would be due May 15, 2015. When you apply for an EIN, we presume you’re legally formed and the clock starts running on this three-year period.Įxample: Your organization applies for an EIN in November 2014 and chooses a December accounting period. Nearly all organizations exempt under IRC 501(a) are subject to automatic revocation of their tax-exempt status if they fail to file a required annual information return or notice for three consecutive years.

If you believe your organization qualifies for tax exempt status (whether or not you have a requirement to apply for a formal ruling), be sure your organization is formed legally before you apply for an EIN. Purpose of an Employer Identification NumberĮmployer Identification Numbers are issued for the purpose of tax administration and are not intended for participation in any other activities (e.g., tax lien auction or sales, lotteries, etc.) Exempt Organization Information

We apologize for any inconvenience this may cause you. Please use one of our other methods to apply. We cannot process your application online if the responsible party is an entity with an EIN previously obtained through the Internet. Copies can be requested online (search “Forms and Publications) or by calling 1-800-TAX-FORM.

HOW TO GET AN APP FOR MY BUSINESS DOWNLOAD

We recommend employers download these publications from IRS.gov.

HOW TO GET AN APP FOR MY BUSINESS PDF

More complex issues are discussed in Publication 15-A PDF and tax treatment of many employee benefits can be found in Publication 15. Publication 15 PDF provides information on employer tax responsibilities related to taxable wages, employment tax withholding and which tax returns must be filed. You can then download, save, and print your EIN confirmation notice.Īpply Online Now Employer Tax Responsibilities Explained (Publications 15, 15-A and 15B)

0 kommentar(er)

0 kommentar(er)